5 Steps to Building the Best Small Business Bookkeeping Checklist in 2023

You know your business like the back of your hand. But how well do you understand the financial side? Let’s face it: when it comes to bookkeeping and accounting, we could all use a little help. Where do your bookkeeping tasks start? What do you need to complete every day? Every week? And what about your year-end taxes? If you’re new to business finances, no problem — we’ve got the solutions. To stay on top of your bookkeeping, we recommend an automated payroll partner and a personal bookkeeping checklist.

Who needs a bookkeeping checklist?

So, who needs a bookkeeping checklist? The short answer: everyone. Understanding your finances is essential to sustainability and growth — you need to know how to organize and analyze your books. Plus, a bookkeeping checklist can help you track income and expenses and optimize your profits. It’s a necessary tool for any business owner. But where do you start? Of course, you should tailor your bookkeeping checklist to your business, but there are some essential points every list should include. We’ll cover those now. Remember, if you’re working with an accountant (or any of your employees), you can include them in your checklist and manage their progress.

What’s in a bookkeeping checklist: your step-by-step guide

Analyze your cash position

This task is first for a reason: without cash, your business will struggle to operate, so you need to know how much you have on hand. Start by measuring how much you expect to receive and spend in the coming weeks and months. Then, look ahead at upcoming expenses and ensure you’ll have the cash to match. Checking your cash position is one of your few daily bookkeeping tasks, but it’s easy to overlook. Create a habit of checking your cash at the beginning and end of every day.

Document unpaid bills

After you’ve analyzed your cash position, you should monitor your expenses. Every business owner has one primary goal: to make more money than they spend. And keeping tabs on your income and expenses is the only way to ensure you’re doing that. When tracking your expenses, you should have a folder for unpaid bills. Also, note the due dates and payment amounts — these will be crucial when developing your weekly and monthly budgets.

Send payments, pay vendors

If you’ve followed the previous step in the checklist, you should have some funds set aside to pay your suppliers. Now, you have to send the payments — and this isn’t something you want to fall behind on. You’ll probably be making payments online or by cheque (ugh), and after you send the money, make sure you’re keeping records for tax season. Remember, suppliers are essential to the success of your business — so try your best to pay on time to build trust. Keeping your suppliers informed about the status of payments, order changes or any other updates is also key to maintaining that successful relationship. And the best way to do that? Making sure your books are organized.

Review past-due invoices

Following up on unpaid invoices is nobody’s favourite task, but you need to do it; we’ve covered your expenses and outgoing payment, and now it’s time to keep tabs on your income. If you’re sending lots of invoices, we recommend looking at invoice software — it’ll help you get paid faster and better track your income. Setting payment terms (like due dates) is also advisable. The exact day may vary, but you should specify it to ensure your receive payment promptly. Additionally, you’ll want to include any late payment fees so that your customers know of any penalties they may incur. Invoice management is a vital part of bookkeeping and tracking your income.

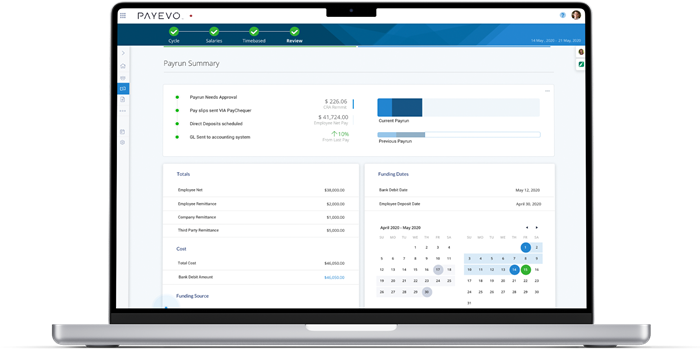

Process payroll

With changing tax rates and differing remittances, payroll can be a time-consuming bookkeeping task — especially for those new to business finance. It’s likely one of your most significant expenses, and you must be accurate and timely. It doesn’t help that you probably need to run payroll every two weeks. Since precision is paramount, we recommend partnering with a payroll service provider — it’ll save you time and ensure you’re always accurate. Plus, with payroll services, you’ll have someone to help you with tax filing, employee questions, and government updates — you’re guaranteed to be up-to-date.