Forget your chequebook.

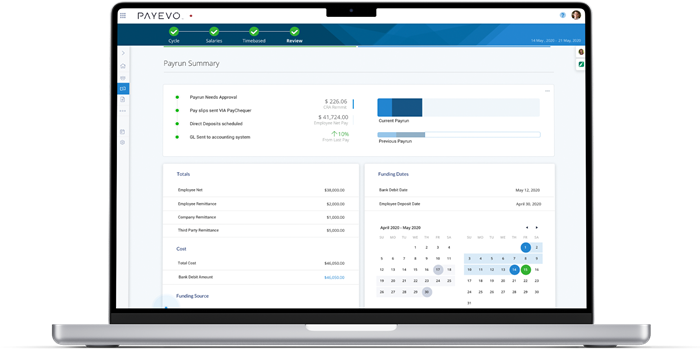

PaymentEvolution Payroll provides fully integrated ePay - electronic payment services. You can directly deposit your employee payroll into their bank accounts - on time, securely and accurately.

No more cheques

Finalize your payroll, and we'll automatically issue payments to your staff.

Save money: it typically costs a small business over $2 to issue a cheque. With Payroll by PaymentEvolution, ePay is included to pay your staff.

Go green: no more paper, lost cheques, reissues, or stop payments - secure, online payments will simplify your payroll.

How it works

PaymentEvolution ePay is the fast, simple way to pay your staff - all online. Funds are directly deposited into their bank accounts.

Funds are debited from your corporate account as one transaction.

Once your funds are cleared, your employees are sent their payments.

Processing time is as quick as 1 business day when using wire or Interac funding. Processing time is 5 business days when funded via bank debit, but you may qualify for expedited processing. Contact us for more details.

| Service | Fee |

|---|---|

| Transactions | As low as $2.00 /emp/pay |

| B2B Transactions | As low as $1.50 per B2B transaction |

| Remittance | CRA remittances are included. Pay additional third-party remittances as low as $2.00 per run. |

| Rush Remittance | $30 per occurrence |

| Rush, rejected payments, chargebacks, changes etc. | $30 per occurrence |

| Rejected funding of payments, NSF | $50 per occurrence Multiple NSFs may incur additional fees and service suspension. |

| Trace, investigations, specialist etc. | $199/hr |

| ePay setup fee (per source account) | $55 plus applicable taxes |

| Automated ROE submission service | $5 plus applicable taxes |

| Automated T4 / T4A/ RL1 submission service | $30 plus applicable taxes |